In a groundbreaking move that underscores the UK government's commitment to green energy initiatives, an announcement was made regarding the extension of Value Added Tax (VAT) relief on battery storage systems. This significant decision is poised to have far-reaching implications on the renewable energy landscape, with a focus on encouraging sustainable practices and fostering the adoption of battery storage solutions. As we delve into the intricacies of this policy shift, we will explore the changes in VAT on solar batteries, scrutinize the beneficiaries of this exemption, assess the opportune moment for investment, and reflect on the broader impacts of this visionary decision.

Quoting the UK government's commitment to sustainability, "The government does concur with the respondents, however, that this technology brings electrical battery storage into the purview of the relief because it satisfies all of the stated goals for this VAT relief in and of itself. It implies that when the technology is installed as a standalone device that is connected to the grid or retrofitted with approved energy-saving materials, it will now also be eligible for VAT exemption.."

What is Changing in VAT Compared With The Previous One?

The landscape of renewable energy has been subject to continuous evolution, and one of the recent pivotal moments has been the announcement of VAT relief on battery storage systems. Previously, consumers faced the burden of VAT on these essential components of renewable energy systems, hindering the widespread adoption of sustainable practices.

The UK government's announcement to provide tax relief on battery storage systems marks a significant departure from the previous taxation regime. This move is indicative of a paradigm shift in the government's approach, as it recognizes the pivotal role battery storage plays in enhancing the efficiency and reliability of renewable energy solutions.

The recent changes in VAT on solar batteries in the UK represent a significant departure from the previous tax landscape. It reflects the UK government's commitment to fostering a greener and more sustainable energy future. Previously, the imposition of VAT on battery storage hindered the widespread adoption of these crucial components, limiting the growth of the renewable energy sector. The recent policy shift aims to rectify this by making such investments more financially feasible, signaling a clear intent to drive the transition towards cleaner and more sustainable energy practices.

Projects where a solar array and energy storage are installed together. Here, the home's occupant(s) fully utilizes solar and storage power. Specifically, they may optimize their energy use, store extra energy for later use, and maximize their investment in renewables. They are also making the energy infrastructure more sustainable and resilient in the process.

Projects that install a battery without providing solar support. In these cases, residents can use smart tariffs to charge their batteries at a low cost overnight. (When the energy passing through the wires is the least expensive and most pure.) Then, during peak hours, they can release the energy that has been stored in their battery. By doing this, the grid is less stressed during peak demand, fewer fossil fuels are burned, and billpayers benefit financially.

Projects that include adding a battery to an already-existing solar array. The billpayer can store solar energy to run solar power morning, noon, and night by installing a storage battery. Then, they will be able to reduce their home's carbon footprint, save more money on energy bills, and have more control over how much energy they use. Again, all of this contributes to a grid that is cleaner and easier to manage.

Who will Benefit from VAT on Battery Storage?

The impact of VAT on battery storage systems extends across a spectrum of stakeholders, bringing about positive implications for both individual consumers and businesses invested in renewable energy. Homeowners seeking to integrate solar panels with battery storage will find the financial burden significantly reduced, making the transition to sustainable energy more accessible.

Businesses, particularly those involved in large-scale renewable energy projects, stand to gain substantial advantages from this policy shift. The relief on VAT for battery storage systems fosters a more conducive environment for green initiatives and enhances the economic feasibility of implementing large-scale renewable energy solutions.

Is It A Good Time to Invest in Battery Storage?

Undoubtedly, the current landscape, with the UK government's recent announcement of VAT relief on battery storage systems, presents a highly opportune moment for individuals and businesses to invest in this transformative technology. The removal of the VAT burden not only makes battery storage more economically viable but also positions it as a strategic investment for those looking to embrace sustainable energy practices.

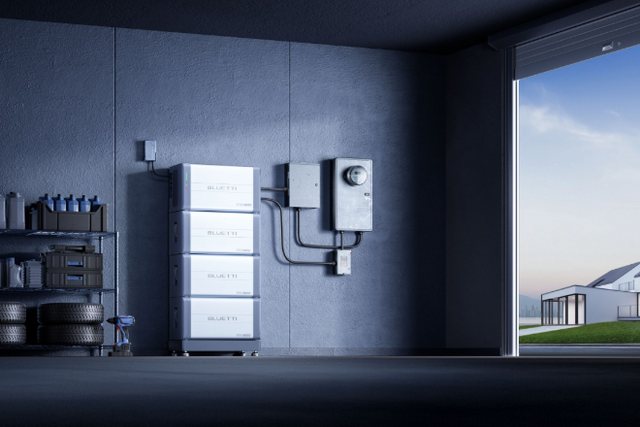

In light of this, the BLUETTI EP500Pro emerges as an exceptional choice for those considering an investment in battery storage. Boasting a substantial 5120Wh LiFePO4 battery with an impressive 3500+ cycles to 80% capacity, the EP500Pro guarantees longevity and reliability. Its 3000W pure sine wave output ensures a stable and efficient power supply, making it an ideal solution for a variety of applications.

One of the standout features of the BLUETTI EP500Pro is its versatility. As a movable power station, it provides flexibility in deployment, allowing users to adapt to different energy storage needs. Whether utilized in an in-grid UPS mode for continuous power supply or a flexible UPS mode, the EP500Pro ensures a seamless transition between power sources, offering 24/7 reliability.

Designed for off-grid energy storage, the EP500Pro enables users to harness and store renewable energy efficiently. Its capability to load multiple devices simultaneously makes it a practical solution for both residential and commercial applications. The flexible recharging options further enhance its usability, ensuring that the EP500Pro remains powered and ready for use at all times.

Impacts of The Change On VAT

Energy storage devices, a vital part of using green energy, will become much more financially viable with the implementation of this regulation in 2024. Not only will this VAT decrease bring down the acquisition cost of these systems, but it will also increase their appeal as an investment for customers. The creation, storage, and administration of green energy will become more accessible to consumers, leading to an increase in consumer engagement.

Users of solar PV systems stand to gain, especially from the decision to remove VAT on battery storage systems. Energy storage devices can be more affordably purchased by homeowners and companies, allowing them to store and control solar energy more efficiently. It increases solar energy consumption efficiency and is essential to the wider use of renewable energy sources.

The UK Government's goal for a technology-driven, market-led transition to decarbonize the UK economy is advanced significantly by this strategy. The government is aggressively encouraging the adoption of sustainable practices across multiple industries by lowering the cost and increasing the accessibility of green technologies. This action demonstrates the UK's strong commitment to battling climate change and promoting a sustainable future. It is in perfect alignment with the country's ambitious objective of reaching net zero by 2050.

It is anticipated that the 0% VAT rate, which takes effect in February 2024, will spur the market expansion for renewable energy. Energy storage and management system improvements are facilitated by its promotion of innovation and investment in environmentally friendly technologies. In addition to improving the environment, this strategy boosts the economy by bringing in investments and new job possibilities in the green technology industry.

People Also Ask About VAT On Battery Storage

When will the VAT Exemption on Battery Storage Start?

The new policy will go into effect on February 1st, 2024.

How Long will VAT on Battery Storage be 0%?

The United Kingdom-wide tax relief on these technologies is scheduled to expire on March 31, 2027. Following that, the tax will revert to the original 20% VAT at a reduced rate of 5%.

Conclusion

The UK government's decision to extend VAT on solar batteries in 2023 marks a transformative moment for the renewable energy landscape. By eliminating the tax burden on these essential components, the government has paved the way for a more sustainable and economically viable future.

Analyzing the changes in VAT regulations, understanding the beneficiaries of this policy shift, and exploring the opportune time for investment provides a comprehensive view of the implications. The recommendation of the BLUETTI EP500Pro as a strategic investment underscores the practical aspects of capitalizing on this policy change.

Shop products from this article

You May Also Like

Sodium-Ion vs Lithium-Ion Battery: The Real Science behind Cold Weather Battery Drain

Why is sodium-ion battery often considered more reliable in winter? Do you know the real science behind it? In this guide, you will explore the comparison between lithium-ion and sodium-ion...

Oven Power Consumption Explained: How Much Electricity Does Your Oven Use?

Have you ever thought about how much electricity your oven uses? What's the power rating in UK homes, or the associated cost with it? Discover some tips to reduce your...

Is the UK's Power Grid at Risk of Blackout?

Learning from Iberia's 14-hour blackout. With 40% renewable energy, Britain faces similar grid stability challenges. Discover how home energy storage solutions like BLUETTI provide critical backup power and enhance grid...